The most frequently asked question I get about real estate is some version of this: “Are we in a real estate bubble? When are prices going to start dropping in our neighborhood?”

My short answer – no, and never.

I’m not being facetious here. Prices may drop seasonally, for a month or two, and there may come a time, in five or 10 or 15 years when southwest Minneapolis prices have risen so high that they may need to drop a bit... But we are not overpriced yet. The prices in 2024 will be higher than 2022. Bet on it.

Last spring, I made a few predictions, and while it may be too soon to confirm anything, so far those predictions have borne out. Here’s what I said in March:

Prediction # 1 – Single family home prices will continue to rise. The value of land, and single family homes, is still increasing, and despite 10 years of significant appreciation, prices have not even come close to peaking in Minneapolis.

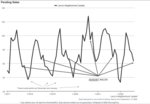

And here’s the latest graph: NOTE: median prices are up 2% in the last 5 months.

Prediction #2 – Multiple offers will be the norm in southwest from now until June. For the last five years, late winter and spring have been highly competitive, and by June, things were slowing down. Note to sellers: It’s far better to enter the market in April/May than in July/August.

Here is a graph that may be helpful to any of you who are planning your real estate investment future.

It’s clear. August is a very difficult month to sell a house, relative to June. In every year except one, September was better. (Note that only in 2019 was there not a slight sales uptick in September.)

Sometimes it’s hard to plan your real estate sales and purchases. Life events often take precedence over timing. But if you can get your house on the market in June, rather than August, chances are you’ll move it faster, and consequently, you’ll likely sell it for more money.

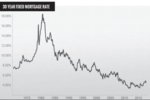

REGARDING INTEREST RATES:

We’ve heard the news: Rates are up, a lot, in the last year. In October of 2021 you could get a 30-year mortgage for 3%. Rates have more than doubled since then.

So, why are we not in a panic? Why is it still a good time to buy in the Twin Cities?

One reason is that, historically speaking, rates of 7% are still well below the last 50 years average.

My own context is this: when I started selling real estate 23 years ago in 1999, my seasoned mentors and colleagues were thrilled that the rates were all the way down to 7%.

Rates hardly seemed to affect sales this year. Closed sales virtually mirrored new listings, meaning that the reason there were fewer transactions this year had more to do with supply than demand. Meanwhile, as I mentioned, prices were still up.

So, if you’re worried about your home value plummeting someday – don’t be. Not if you live around here.

And if you’re planning on waiting to purchase here until prices go down... Chances are they will never be lower than they are now. I know it’s bold for me to say so – but I really think it’s true. I’m bullish on Minneapolis. We have not hit our values-peak.

Comments

No comments on this item Please log in to comment by clicking here